“Even if you are on the right track, you'll get run over if you just sit there.”

Will Rogers

“आप सही रास्ते पर हों तब भी अगर आप बैठे रहेंगे तो आप पीछे रह जाएंगें।”

विल रॉजर्स

“Even if you are on the right track, you'll get run over if you just sit there.”

Will Rogers

“आप सही रास्ते पर हों तब भी अगर आप बैठे रहेंगे तो आप पीछे रह जाएंगें।”

विल रॉजर्स

“Sir, you don’t look a day older than 50!” This was the optician, while going through the date of birth entry in the form I was required to fill. My wife, who was with me, immediately whispered into my ears that I should take this remark merely as a marketing strategy.

Not having any requirement of strategies, marketing or otherwise, she was in no frame of mind to have me harbour any grandiose delusions of my age! Be that as it may, I was left wondering why should people get concerned if they get old or look as old as they are. The desire of getting to be told that they look younger than they are is, perhaps, an understandable variant of vanity.

One often comes across observations such as “He/she is so graceful even at his/her age” or “He/she has aged gracefully.” I presume the observation, at least in part, is based on seeing people who have accepted old age with dignity and a measure of calmness. On the other hand, there are people who appear tormented and beleaguered by age and show it too and when that happens, we say, “He/she looks so much older than he/she is.”

Ageing is a natural process and not a matter of choice, but how we handle it, is! There is no known elixir bestowing on humans youth and vitality which will defy and reverse the process of ageing. And thank god for that! Imagine a world bursting at the seams with young “old” people who have defied ageing!

A wise man had once said, “A beautiful face in youth is the result of fortune; a beautiful face in old age is earned by kindness and wisdom.” There are, of course, challenges in how parents and senior citizens are treated by their children. Some cases of “seniors” being ignored or being stifled financially or emotionally or both are dark and sinister facts of today’s times, and though laws such as the Maintenance of Parents and Senior Citizens (Amendment) Bill, 2019 (awaiting passage in Parliament) are on the anvil, what is required is understanding and empathy, not limited to finances alone, from the kin of the seniors.

Since ageing is inevitable in life’s journey, it is important also to explore and find ways and means to enjoy the journey. These days, concepts such as assisted living with regular health check-ups and nursing care have found currency. In such senior citizens’ homes, “seniors” are eased into secured community living sans the hassles of mundane household chores such as dusting, cleaning and even cooking.

For ageing, one has to live, and when one lives with satisfaction and happiness, there need be no regret, for as is said, “Do not regret growing older, it is a privilege denied to many.”

Ashok Warrier

Source: The Hindu, 28/11/21

Let me explain. I was born a decade before India liberalized. While I was spared the acute insecurities of our parents’ generation which grew in a newly independent, socialist India, I have had my share. My first time abroad in the late 1990s was eye-opening: sleek air-conditioned taxis instead of rickety Ambassadors, comfortable public transport instead of tin boxes, pothole-free roads where vehicles followed lanes and traffic rules.Subsequently, the engineering college I went to resembled an international departure lounge. Not going abroad was considered a mark of lower calibre.

This trend continued when I started working. In one international consulting firm, I was sent to Sweden to identify “low-end" work that could be done in India. Ironically, the consultants doing this work were from the most competitive colleges in the world. I know someone who ranked in the teens in IIT-JEE and was being used by a similar international firm to provide back-end valuation support. India-based consultants, no matter how capable, were meant to deliver non-core, low-end work cheap, and increase project margins. This business model is now leveraged by almost all international consulting firms.

Similarly, India’s enduring success story, the IT services industry, is built predominantly around this cost-leadership framework. Clients are willing to pay a substantial premium for foreign firms compared to their Indian counterparts, though both get most of their work done in India, often leveraging the same talent pool.

It is the same in management consulting. As we build an India-bred global consulting firm, we get regularly raided by international majors for talent. The same consultants are then deployed at twice or thrice the rate (sometimes, ironically, to the same client). This rate jumps to five or six times when the same consultant relocates abroad. Effectively, clients are willing to spend five to six times on the same consultant based on the brand and location.

This creates a vicious cycle. Clients expect Indian firms to be cheap, irrespective of the quality of work. Indian firms find it easy to sell at lower costs, even when the quality is world-class. As we try to sell globally, based on the quality of our work rather than cost, we are experiencing the systemic challenges this vicious cycle creates for India-bred firms.

Fortunately, things are changing. In the past five years, I have landed at foreign airports and overheard comments on how Indian airports are much better. Forward-thinking global infrastructure companies prefer to be in India, given its evolved public-private partnership framework. One of our Japanese clients recently acquired an Indian technology firm to access its offerings and leadership, not cheap engineers. Our SaaS (software-as-a-service) companies are competing effectively with their global counterparts. India’s digital payment infrastructure is world-class, as is its ability to deliver social services through technology (think Co-Win.) India is attracting an unprecedented amount of venture capital that is transforming our startup ecosystem. Today, in India’s top campuses, students aspire for product management roles in startups, not go abroad.

While jingoistic claims of general superiority are self-defeating, the fact is that India now has enough instances where it is world-class. We need to identify these areas and take our expertise to the world and charge top dollars for it. Covid-19 has ensured that clients are now willing to pay for talent and quality, not location or brand. This is our chance to transition our business models from cost to thought leadership.

Unfortunately, mindsets require much longer to change than political or economic realities. It is difficult to pivot from decades of competing on price to winning based on quality. Repositioning Indian services companies as thought leaders will require firm commitment, consistent messaging, sustained advocacy and, most importantly, a deep conviction that we can win by adding world-class value, not just by being cheap.

India’s evolution from cost to thought leadership needs to start in our minds. And quickly.

Abhisek Mukherjee is co-founder and director, Auctus Advisors.

Source: Mintepaper, 29/11/21

The Lok Sabha Monday passed the Farm Laws Repeal Bill, 2021 without any discussion. The Bill, which is aimed at repealing three farm laws, was introduced in the house by Union Minister of Agriculture and Farmers’ Welfare Narendra Singh Tomar.

What is the Farm Laws Repeal Bill, 2021?

The Farm Laws Repeal Bill, 2021 is aimed at repealing the three farm laws – Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Act, 2020, the Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, 2020, the Essential Commodities (Amendment) Act, 2020 – and amending the Essential Commodities Act, 1955. The Bill was necessitated after Prime Minister Narendra Modi announced the government’s intention to repeal the three laws in view of ongoing farmers’ protests against these laws on November 19. Two days after the Prime Minister’s announcement, the Union Cabinet cleared the draft of the Bill. Now the Bill has been introduced in Lok Sabha.

How many sections are there in the Bill?

The six-page Bill contains only three sections. The first section defines the title of the Act – the Farm Laws Repeal Act, 2021, the second section has provisions to repeal three farm laws, and the third section relates to omitting sub-section (1A) from section 3 of the Essential Commodities Act, 1955.

What is sub-section (1A) under section 3 of the Essential Commodities Act which is being removed?

The government had inserted sub-section (1A) in the section 3 of the Essential Commodity Act, 1955 that empowers the government to control production, supply, distribution, etc., of essential commodities. The sub-section (1A) provides a mechanism to regulate the supply of foodstuffs, including cereals, pulses, potato, onions, edible oilseeds and oils under “extraordinary circumstances” which may include war, famine, extraordinary price rise and natural calamity of grave nature. It also prescribes the price triggers for imposing stock limits. Under the sub-section (1A), any action on imposing stock limit shall be based on price rise and an order for regulating stock limit of any agricultural produce may be issued if there is a hundred per cent increase in the retail price of horticultural produce; or fifty per cent increase in the retail price of non-perishable agricultural foodstuffs, over the price prevailing immediately preceding twelve months, or average retail price of last five years, whichever is lower.

Has the government given any reason for repeal of the farm laws?

Agriculture Minister Narendra Singh Tomar, who piloted the Farm Laws Repeal Bill, 2021, has stated several reasons for taking this legislative step. In a statement of objects and reasons, which forms the part of the Bill, Tomar said, “Even though only a group of farmers are protesting against these laws, the Government has tried hard to sensitise the farmers on the importance of the Farm Laws and explain the merits through several meetings and other forums.”

“Without taking away the existing mechanisms available to farmers, new avenues were provided for trade of their produce. Besides, farmers were free to select the avenues of their choice where they can get more prices for their produce without any compulsion,” the statement said.

“However, the operation of the aforesaid Farm laws has been stayed by the Hon’ble Supreme Court of India. During the COVID period, the farmers have worked hard to increase production and fulfil the needs of the nation. As we celebrate the 75th Year of Independence— “Azadi Ka Amrit Mahotsav”, the need of the hour is to take everyone together on the path of inclusive growth and development,” it said.

“In view of the above, the aforesaid Farm Laws are proposed to be repealed. It is also proposed to omit sub-section (1A) of section 3 of the Essential Commodities Act, 1955 (10 of 1955) which was inserted vide the Essential Commodities (Amendment) Act, 2020 (22 of 2020),” it states.

How many days the farm laws were in effect?

The journey of three farm laws began on June 5, 2020 when the President of India promulgated three ordinances – Essential Commodities (Amendment) Ordinance, 2020; The Farming Produce Trade and Commerce (Promotion and Facilitation) Ordinance, 2020; and The Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Ordinance, 2020. These ordinances were later replaced with proper legislation in September 2020. However, the implementation of three farm laws was stayed by the Supreme Court on January 12, 2021. So, these laws were in effect for only 221 days

Written by Harikishan Sharma

Source: Indian Express, 29/11/21

“The consequences of today are determined by the actions of the past. To change your future, alter your decisions today.”

Anonymous

“आज के परिणाम अतीत के कर्मों से निर्धारित होते हैं। अपने भविष्य को बदल पाने के लिए अपने आज के फैसलों को बदलें।”

अज्ञात

On November 26, 1949, the Constituent Assembly adopted the Constitution of India, and it came into effect on January 26, 1950. Seventy-two years later, the Constitution of India has added several amendments, sections, and articles.

To spread awareness on various mandates of the Constitution, several bodies that conduct competitive examinations still give high weightage to the topic.

The syllabus of the UPSC Civil Service, SSC-CGL, NDA and other such examinations intensely covers the Indian Constitution in all stages of the test. In recent years, the UPSC preliminary exam has had at least 7-8 questions on the Constitution whereas, in the mains, the topic is largely covered in the GS II syllabus. This makes reading and understanding the Indian Constitution a prerequisite for qualifying the exam.

While the Constitution is self-explanatory, the charter language often confuses aspirants. Various platforms host online workshops as well as courses on key features of the Indian Constitution, which can be a good way to understand it in a simple and jargon-free manner.

Course on the Indian Constitution – Ministry of Law & Justice, NALSAR Hyderabad

The Department of Legal Affairs, Ministry of Law & Justice, in collaboration with NALSAR University of Law, Hyderabad, has launched an online course on the Indian Constitution which will be available on the website at legalaffairs.nalsar.ac.in. The registration for this course is free of cost. However, for those who wish to obtain a certificate of appreciation or certificate of merit, a token fee of Rs 100 will be charged, as per an official statement. The online course has 15 conceptual videos and the first video lecture shall be available upon registration.

Constitution of India – Udemy

Udemy, an online learning platform, offers a “Constitution of India” course. The course highlights key features of the Indian Constitution and aims at providing general awareness about the Indian Constitution. Some of the topics are read like a podcast so as to provide learners with the feel of audiobooks.

Indian Polity and Constitution – Udemy

Similarly, another programme, “Indian Polity and Constitution’ course at Udemy covers the detailed concept of constitutional framework, system of government, constitutional and non-constitutional bodies etc. The programme is specifically designed for competitive exam aspirants. The course is divided into 51 lectures spanning approximately three hours. The participants are provided with a certificate on completion of the course.

Constitutional law in 90 minutes – Udemy

If you are short of time and need a fast-track summary of the constitutional framework then ‘Constitutional Law in 90 Minutes’ is the course for you. The course can be helpful for law students as well as students opting for law optional at the UPSC Civil Service exam. This course will give you a “bird’s eye” overview of the entire subject.

The Constitution of India (Part 1) – Finology learn

Finology learn provides an elaborative course to understand the drafting and implementation of important provisions of the Constitution. The course offers 20 modules covering 60+ topics. The modules are provided through video lectures and comprehensive notes and a certificate is provided to studentFundamental Rights in the Indian Constitution – My law

This course provides a detailed understanding of what fundamental rights mean, their purpose in the Constitution, and how the Supreme Court of India has interpreted them.

In addition to unit-wise practise exercises, this course offers a Course Completion Test (CCT). To qualify for the CCT, a learner has to complete more than 90 per cent of the course. The CCT is conducted online to provide maximum flexibility to the learner. Based on the results of the CCT, a learner will be given a certificate, which is recognised by various employers in the legal industry.s on completion of the course.

Source: Indian Express, 27/11/21

Why are the unions seeking legal guarantee for MSP?

The Centre currently announces the MSPs of 23 crops. They include 7 cereals (paddy, wheat, maize, bajra, jowar, ragi and barley), 5 pulses (chana, tur/arhar, moong, urad and masur), 7 oilseeds (rapeseed-mustard, groundnut, soyabean, sunflower, sesamum, safflower and nigerseed) and 4 commercial crops (sugarcane, cotton, copra and raw jute). While the MSPs technically ensure a minimum 50% return on all cultivation costs, these are largely on paper. In most crops grown across much of India, the prices received by farmers, especially during harvest time, are well below the officially-declared MSPs. And since MSPs have no statutory backing, they cannot demand these as a matter of right. The unions want the Modi government to enact legislation conferring mandatory status to MSP, rather than just being an indicative or desired price.

How can that entitlement be implemented?

There are basically three ways.

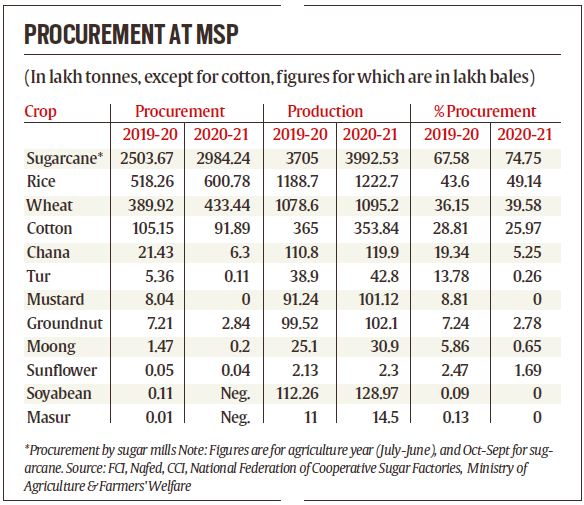

The first is by forcing private traders or processors to pay MSP. This is already applicable in sugarcane. Sugar mills are required, by law, to pay farmers the Centre’s “fair and remunerative price” for cane, with some state governments fixing even higher so-called “advised prices”. The Sugarcane (Control) Order, 1966 issued under the Essential Commodities Act, moreover, obliges payment of this legally-guaranteed price within 14 days of cane purchase. During the 2020-21 sugar year (October-September), mills crushed some 298 million tonnes (mt) of cane, which, the accompanying table shows, was close to three-fourths of the country’s estimated total production of 399 mt.

The second is by the government undertaking procurement at MSP through its agencies such as the Food Corporation of India (FCI), National Agricultural Cooperative Marketing Federation of India (Nafed) and Cotton Corporation of India (CCI). As can be seen from the table, such purchases accounted for nearly 50% of India’s rice/paddy production last year, while amounting to 40% for wheat and over 25% in cotton. Government agencies also bought significant quantities – upwards of 0.1 mt – of chana (chickpea), mustard, groundnut, tur (pigeon-pea) and moong (green gram) during 2019-20. Much of that was post the Covid-induced nationwide lockdown in April-June 2020, when the winter-spring rabi crops were being marketed by farmers. Procurement of these crops, however, fell in 2020-21. In the case of mustard, tur, moong, masur (yellow lentil) and soyabean, the need for procurement wasn’t really felt, as open market prices largely ruled above MSPs.

The second is by the government undertaking procurement at MSP through its agencies such as the Food Corporation of India (FCI), National Agricultural Cooperative Marketing Federation of India (Nafed) and Cotton Corporation of India (CCI). As can be seen from the table, such purchases accounted for nearly 50% of India’s rice/paddy production last year, while amounting to 40% for wheat and over 25% in cotton. Government agencies also bought significant quantities – upwards of 0.1 mt – of chana (chickpea), mustard, groundnut, tur (pigeon-pea) and moong (green gram) during 2019-20. Much of that was post the Covid-induced nationwide lockdown in April-June 2020, when the winter-spring rabi crops were being marketed by farmers. Procurement of these crops, however, fell in 2020-21. In the case of mustard, tur, moong, masur (yellow lentil) and soyabean, the need for procurement wasn’t really felt, as open market prices largely ruled above MSPs.

Generally speaking, MSP implementation has been effective only in four crops (sugarcane, paddy, wheat and cotton); partly so in five (chana, mustard, groundnut, tur and moong) and weak/non-existent in the remaining 14 notified crops. In livestock and horticultural produce – be it milk, eggs, onions, potatoes or apples – there is no MSP even on paper! The 23 MSP crops together, in turn, account for hardly a third of the total value of India’s agricultural output, excluding forestry and fishing.

The third route for guaranteeing MSP is via price deficiency payments. Under it, the government neither directly purchases nor forces the private industry to pay MSP. Instead, it allows all sales by farmers to take place at the prevailing market prices. Farmers are simply paid the difference between the government’s MSP and the average market price for the particular crop during the harvesting season.

What would be the fiscal cost of making the MSP legally binding?

The MSP value of the total output of all the 23 notified crops worked out to about Rs 11.9 lakh crore in 2020-21. But this entire produce wouldn’t have got marketed. The marketed surplus ratio – what remains after retention by farmers for self-consumption, seed and feeding of animals – is estimated to range from below 50% for ragi and 65-70% for bajra (pearl-millet) and jowar (sorghum), to 75-85% for wheat, paddy and sugarcane, 90%-plus for most pulses and 95-100% for cotton, soyabean, sunflower and jute. Taking an average of 75% yields a number – the MSP value of production actually sold by farmers – just under Rs 9 lakh crore.

The government is further, as it is, procuring many crops. The MSP value of the 89.42 mt of paddy and 43.34 mt of wheat alone bought during 2020-21 was around Rs 253,275 crore. To this, one must add the MSP value of pulses and oilseeds purchased by Nafed (Rs 21,901 crore in 2019-20 and Rs 4,948 crore in 2020-21) and kapas or raw un-ginned cotton by CCI (Rs 28,420 crore in 2019-20 and Rs 26,245 crore in 2020-21). Besides, the MSP value of the sugarcane crushed by mills (Rs 92,000 crore in 2020-21) has to be considered.

All in all, then, the MSP is already being enforced, directly or through fiat, on roughly Rs 3.8 lakh crore worth of produce. Providing legal guarantee for the entire marketable surplus of the 23 MSP crops would mean covering another Rs 5 lakh crore or so. It would be even lower, given two things. The crop that is bought by the government also gets sold, with the revenues from that partly offsetting the expenditures from MSP procurement. Secondly, government agencies needn’t buy every single grain coming in to the mandis. Mopping up even a quarter of market arrivals is often enough to lift prices above MSPs in most crops.

But there must be a catch to all these calculations?

Yes. FCI’s grain mountain is evidence of how cumbersome public procurement and stocking operations can be. This is not to mention the huge scope for corruption and recycling/leakage of wheat and rice, whether from godowns, ration shops or in transit. Also, while cereals and pulses can be sold through the public distribution system, disposal becomes complicated in the case of nigerseed, sesamum or safflower. Even when it comes to sugarcane, the experience of mills accumulating huge payment arrears to growers is proof of the practical limitations of “legal MSP”.

That leaves deficiency payments, which may be a more workable and fiscally feasible option in the long run. There is, in addition, a growing consensus among economists for guaranteeing minimum “incomes”, as against “prices”, to farmers. That would essentially entail making more direct cash transfers either on a flat per-acre (as in the Telangana government’s Rythu Bandhu scheme) or per-farm household (the Centre’s PM-Kisan) basis.

Written by Harish Damodaran

Source: Indian Express, 29/11/21