Let me explain. I was born a decade before India liberalized. While I was spared the acute insecurities of our parents’ generation which grew in a newly independent, socialist India, I have had my share. My first time abroad in the late 1990s was eye-opening: sleek air-conditioned taxis instead of rickety Ambassadors, comfortable public transport instead of tin boxes, pothole-free roads where vehicles followed lanes and traffic rules.Subsequently, the engineering college I went to resembled an international departure lounge. Not going abroad was considered a mark of lower calibre.

This trend continued when I started working. In one international consulting firm, I was sent to Sweden to identify “low-end" work that could be done in India. Ironically, the consultants doing this work were from the most competitive colleges in the world. I know someone who ranked in the teens in IIT-JEE and was being used by a similar international firm to provide back-end valuation support. India-based consultants, no matter how capable, were meant to deliver non-core, low-end work cheap, and increase project margins. This business model is now leveraged by almost all international consulting firms.

A familiar story

Similarly, India’s enduring success story, the IT services industry, is built predominantly around this cost-leadership framework. Clients are willing to pay a substantial premium for foreign firms compared to their Indian counterparts, though both get most of their work done in India, often leveraging the same talent pool.

It is the same in management consulting. As we build an India-bred global consulting firm, we get regularly raided by international majors for talent. The same consultants are then deployed at twice or thrice the rate (sometimes, ironically, to the same client). This rate jumps to five or six times when the same consultant relocates abroad. Effectively, clients are willing to spend five to six times on the same consultant based on the brand and location.

This creates a vicious cycle. Clients expect Indian firms to be cheap, irrespective of the quality of work. Indian firms find it easy to sell at lower costs, even when the quality is world-class. As we try to sell globally, based on the quality of our work rather than cost, we are experiencing the systemic challenges this vicious cycle creates for India-bred firms.

Fortunately, things are changing. In the past five years, I have landed at foreign airports and overheard comments on how Indian airports are much better. Forward-thinking global infrastructure companies prefer to be in India, given its evolved public-private partnership framework. One of our Japanese clients recently acquired an Indian technology firm to access its offerings and leadership, not cheap engineers. Our SaaS (software-as-a-service) companies are competing effectively with their global counterparts. India’s digital payment infrastructure is world-class, as is its ability to deliver social services through technology (think Co-Win.) India is attracting an unprecedented amount of venture capital that is transforming our startup ecosystem. Today, in India’s top campuses, students aspire for product management roles in startups, not go abroad.

A new business model

While jingoistic claims of general superiority are self-defeating, the fact is that India now has enough instances where it is world-class. We need to identify these areas and take our expertise to the world and charge top dollars for it. Covid-19 has ensured that clients are now willing to pay for talent and quality, not location or brand. This is our chance to transition our business models from cost to thought leadership.

Unfortunately, mindsets require much longer to change than political or economic realities. It is difficult to pivot from decades of competing on price to winning based on quality. Repositioning Indian services companies as thought leaders will require firm commitment, consistent messaging, sustained advocacy and, most importantly, a deep conviction that we can win by adding world-class value, not just by being cheap.

India’s evolution from cost to thought leadership needs to start in our minds. And quickly.

Abhisek Mukherjee is co-founder and director, Auctus Advisors.

Source: Mintepaper, 29/11/21

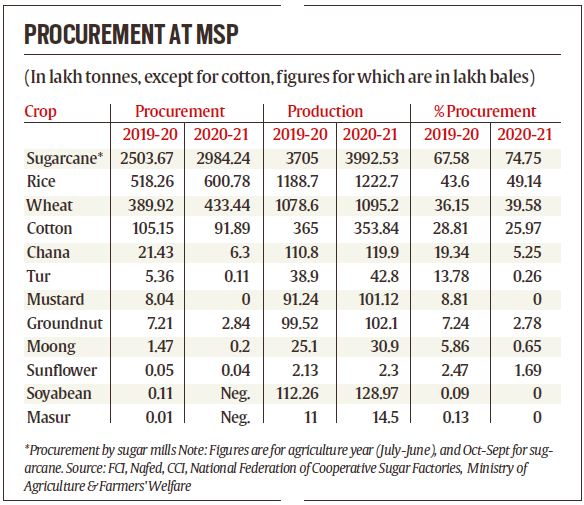

The second is by the government undertaking procurement at MSP through its agencies such as the Food Corporation of India (FCI), National Agricultural Cooperative Marketing Federation of India (Nafed) and Cotton Corporation of India (CCI). As can be seen from the table, such purchases accounted for nearly 50% of India’s rice/paddy production last year, while amounting to 40% for wheat and over 25% in cotton. Government agencies also bought significant quantities – upwards of 0.1 mt – of chana (chickpea), mustard, groundnut, tur (pigeon-pea) and moong (green gram) during 2019-20. Much of that was post the Covid-induced nationwide lockdown in April-June 2020, when the winter-spring rabi crops were being marketed by farmers. Procurement of these crops, however, fell in 2020-21. In the case of mustard, tur, moong, masur (yellow lentil) and soyabean, the need for procurement wasn’t really felt, as open market prices largely ruled above MSPs.

The second is by the government undertaking procurement at MSP through its agencies such as the Food Corporation of India (FCI), National Agricultural Cooperative Marketing Federation of India (Nafed) and Cotton Corporation of India (CCI). As can be seen from the table, such purchases accounted for nearly 50% of India’s rice/paddy production last year, while amounting to 40% for wheat and over 25% in cotton. Government agencies also bought significant quantities – upwards of 0.1 mt – of chana (chickpea), mustard, groundnut, tur (pigeon-pea) and moong (green gram) during 2019-20. Much of that was post the Covid-induced nationwide lockdown in April-June 2020, when the winter-spring rabi crops were being marketed by farmers. Procurement of these crops, however, fell in 2020-21. In the case of mustard, tur, moong, masur (yellow lentil) and soyabean, the need for procurement wasn’t really felt, as open market prices largely ruled above MSPs.